Top 3 challenges blockchain faces to disrupt the banking industry

Blockchain has been one of the most talked-about technologies within the banking sector, given its potential to revolutionize services therein. The hype around the technology has led financial institutions to invest millions of dollars in finding out ways of applying...

How to become a PISP player under PSD2?

The Revised Payment Services Directive has been working on to build a framework for the Third Party Providers like PISP (Payment Initiation Service Provider) and AISP (Account Information Service Provider) to develop services on top of bank’s data. Open Banking under PSD2 has made it all possible with bringing the focus on access to the…

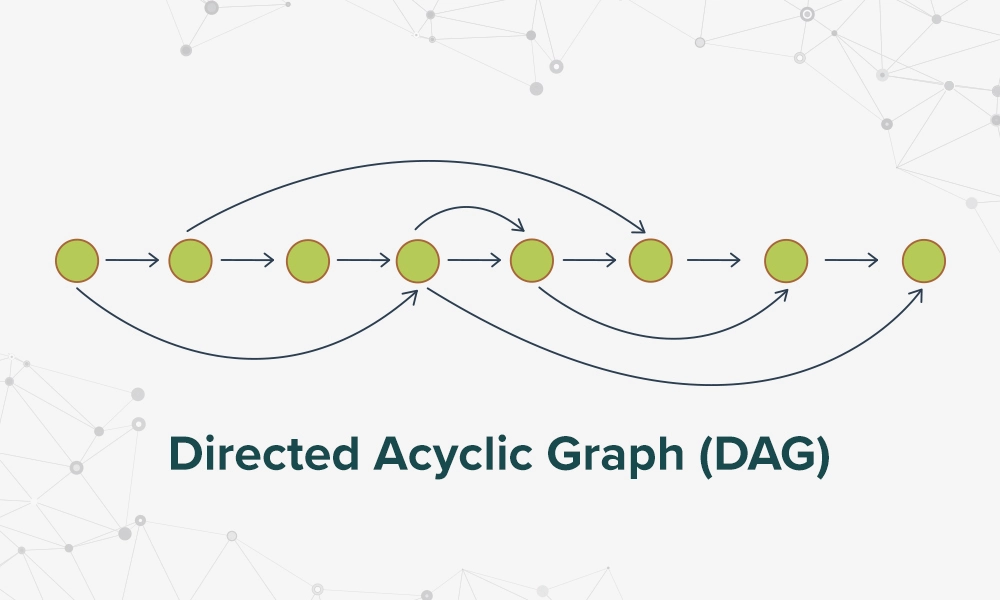

DAG Technology: Going beyond Blockchain

Similar to the internet in its early days, blockchain technology has experienced massive shifts in acceptance and use cases in a short span of time. The underlying technology to Bitcoin is being leveraged by large organizations to disrupt almost all operations and...

Open Banking in the UK: What has changed so far

Since January 2018, when the UK embarked on its open banking experiment, we have heard a lot about it. Now the regulation is almost two years old, we believe that there have been visible changes in the financial landscape, especially for big banks and firms willing to...

How will Open Banking impact the market for lending

With open banking leading the way, large banks, financial institutions, and aspiring third party providers are preparing to redefine the financial services. They will produce more personalized products and services catering to the financial needs of the consumers....

How Big Data can benefit the finance industry

The vast growth of data and technological advancements have significantly transformed the way industries operate and compete. Today, businesses in the finance industry are continuously adopting data-driven approaches to amplify investment decisions and attain...

Open Banking demands customer-centric approach for banks and TPPs

Open banking has gained momentum in the global banking industry. Banks and Fintechs are adopting the new approach to revolutionize services quicker than ever before – keeping customer needs as the focal point. As banks and financial institutions across Europe are...

PSD2 to push transformation of customer experience in banking

Today’s customers want personalized interactions, easy access to their money, and simplified processes when it comes to banking services. A customer’s banking journey ranges from onboarding to transacting and account maintenance. With the increasing demand for...

How PSD2 is a massive opportunity for online merchants

PSD2 is coming into force on this 14th September to set standards for fraud prevention, data usage, and transparent online payments across the EU. The idea behind the directive is to safeguard online transactions, unify the payment system, as well as promote new and...

Real-time payments and PSD2 to drive payment innovation

We live in a world of constant change and increasing speed is the cornerstone for all the services. Disruptive technologies – mobile, cloud, and APIs – have greatly empowered customers who demand convenience, speed, and personalization in the services they get....

Blockchain-based payments to boost cross-border remittance

Remittance pay market plays a significant role in the economic growth of billions of people around the world, especially in developing countries. According to a report by the World Bank, the total value of global digital remittance industry reached $613 billion in...

5 ways lenders can enhance operations with real-time bank data

Today, instant accessibility of financial services has become a major requirement for customers. They want banks and Fintech firms to offer financial services tailored to their need and preferences. The industry has been witnessing changes on similar lines where...

Top 7 trends driving digital transformation in banking (II)

In the previous blog we discussed three trends out of seven driving digital transformation in the banking industry. Now let's have a look at the four trends which are likely to change the face of the industry in times to come. Cloud Computing Even though the adoption...

How can banks endure radical changes under PSD2?

The Revised Payment Services Directive or PSD2 is amongst the most progressive legislations aimed at revolutionizing the payments and the banking industry. The directive strongly focuses on emphasizing payment security, innovation, and market competition. It also aims...

Top 7 trends driving digital transformation in banking (I)

‘Technological innovation’ – these two words are so embedded in our day-to-day life that we have almost forgotten how we used to live without mobile phones or internet or even online banking. We take it as a joke that the banking services were limited to a brick and mortar building which we called ‘bank’ within…