Even though banks remain key players in the finance industry, alternative finance and online lending platforms are witnessing immense growth. According to the report by the Federal Reserve, alternative lenders garnered around 32% of all business loan applications in the year 2018, up from 24% in the preceding year. Another report by Balboa Capital predicts that the market for alternative business loans will reach $350 billion by 2025 in the US. It is not much of a stretch to say that alternative lending has already gained momentum in developed countries and expected to get bigger in emerging economies.

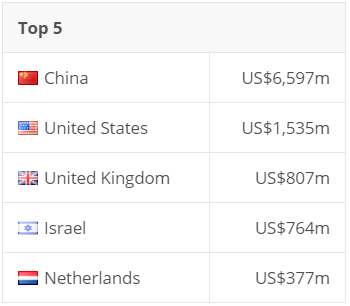

Alternative finance: Total transaction value

Source: Statista.com

Alternative finance industry analysis

The rising popularity of alternative lending platforms has laid a positive impact on the global finance sector. It has accelerated the growth for businesses of all sizes, especially for SMEs and startups that have struggled to secure appropriate finances from legacy institutions. That said, alternative finance models are showing no signs of slowing down. Here are some valuable stats to back it up:

As per statista.com

- China tops the list of top alternative finance markets with a total cumulated transaction value of $6,597 million in 2019.

- Total transaction value in Europe is expected to reach $3,787 million by 2023 with an annual CAGR of 13.2% from 2019-2023.

- According to Oracle’s Digital Demand in Retail Banking study, “40% of consumers say nonbank platforms can assist them better with investment needs and money management.”

A threat to banks?

According to the data reported by SME Finance Forum in 2018, there was a funding gap of $5 trillion between the funding needs of SMEs and the institution-based financing available to them. This has led SMEs to turn towards alternative finance platforms. Moreover, such platforms offer substantial advantages over traditional lending channels:

- A viable lending option when the credit score is low

- Simpler qualification process and quicker approvals

- Funding is faster compared to banks and traditional FIs

- Processes are less complicated

- Paperwork is significantly reduced, thanks to online channels

- More flexibility in terms of paybacks

Types of alternative lending solutions

Mortgage loans

Alternative platforms tend to offer mortgage loans at a lower cost with a simpler qualification process. This combined with the ease of the application process and reduced paperwork enables them to offer loan services in a more attractive way.

SME loans

Given the huge funding gap for SMEs, business loans through nonbank platforms have gained popularity in recent years. This is also because loan applications from small businesses are generally rejected by banks and FIs over low credit score and stringent regulations.

P2P loans and Crowdfunding

Peer-to-peer loans and crowdfunding are the two most popular forms of alternative lending. They help individuals and businesses to raise quick funds without involving in the mundane processes of banks. Crowdfunding promises to be a great way for small businesses to raise funds which have been rejected by banks for finance. Read more at here.

An essential alternative

Perhaps the biggest reason for the immense growth of alternative finance sources is simply demand. Various researches have shown that nonbank lenders have approved more small business loans than large banks in the past couple of years. Moreover, adoption of the latest technologies like AI and Big Data has helped to offer a more comprehensive solution to borrowers.

To conclude, alternative finance platforms still have significant progress to make as banks still hold a major chunk of the market. However, with the benefits it tends to offer, alternative finance could soon become a go-to option for businesses.