COVID-19 has left the world alarmed and confused as the global economy has come to a halt. Numerous industries are witnessing dramatic revenue losses. The fintech industry is no exception.

Fintech has greatly affected services including banking, insurance and investment in recent years. It is one of the fastest-growing industries as per the data from NASSCOM. But as the crisis hit the world, many fintech firms are now under stress with limited funding and reduced revenues. The smaller players may find it even challenging to sustain and keep their operations running.

However, as the global economy shifts from ‘respond’ to ‘recover’ stage, new opportunities are expected to be created for the fintech firms.

The impact of COVID-19

The negative

While the traditional banking system has come to a standstill, a severe impact has been felt on the fintech sector. This can be witnessed due to –

- The lack of proper funding as investors continue to liquidate their funds.

- Reduced revenues with the slowdown in the economy, affecting millions of businesses around the globe.

- The drop in the establishment of new fintech firms.

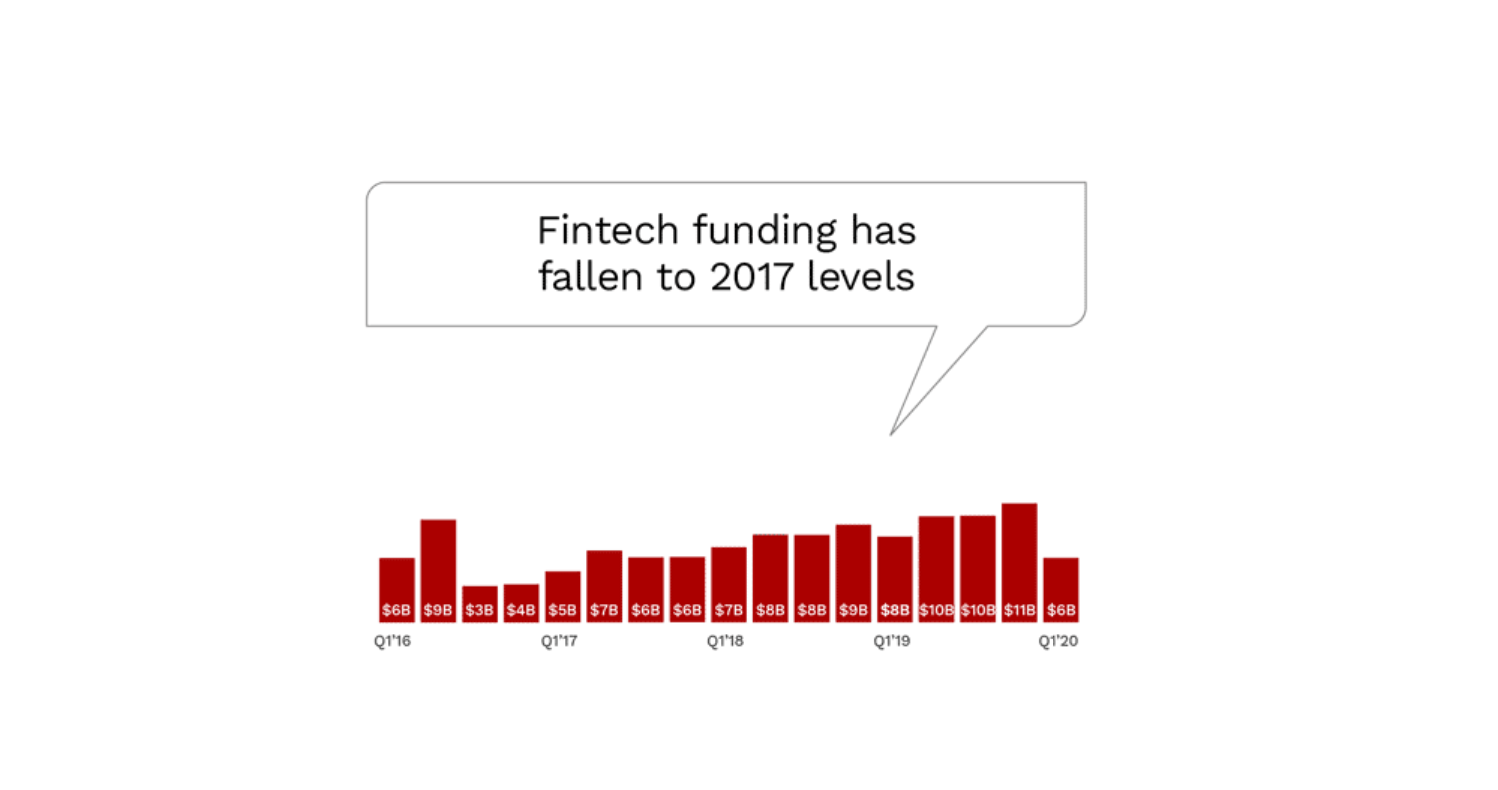

- The sharp reduction in the volume of global fintech deals during the first quarter of 2020

According to a recent survey, more than 40% of the tech firms did not have enough capital to survive past June, and about two-thirds of them cannot survive past September. The crisis has also led to a reduction in digital payments by 30% as consumers are hoarding physical cash for unforeseen circumstances amidst the lockdown.

As CB Insights reports, there has been a downward funding trend with financing activities reaching far below the historical averages. Many fintech companies in the cross-border payments and the lending sector may find it difficult to generate funds due to the market conditions created by the crisis.

The positive

As per deVere Group, the COVID-19 crisis has lead to a substantial 72% rise in the use of fintech apps in Europe. Banking applications in Asia and the Middle East have also witnessed a surge in traffic and number of downloads as people turn towards digital channels to remit money.

A study from Juniper Research found that the ongoing crisis has led to a rise in the number of consumers who wish to gain insights into their financial health, boosting the adoption of Open Banking. That said, the total number of Open Banking users is expected to double between 2019 and 2021, reaching 40 million in 2021.

The crisis has also spurred global investment in contactless payments to avoid the usage of cash. Many fintechs are turning towards technologies like blockchain to build robust and scalable solutions to provide contactless payments.

Tech firms, in general, have experienced a positive or low impact during this time. This is due to the fact they tend to be innovative, fast-changing and well accustomed to the remote culture. Businesses offering EdTech, HealthTech and cloud services have fared well compared to traditional businesses.

Conclusion

The fintech sector has proved to be transformational for the entire financial industry. Despite the economic slowdown, fintechs is expected to play a crucial role in finance post-COVID-19. They are also well-positioned to offer digital solutions to replace traditional systems in this tough time. A key question remains that how fintech companies will leverage technology and innovation to seize this opportunity.