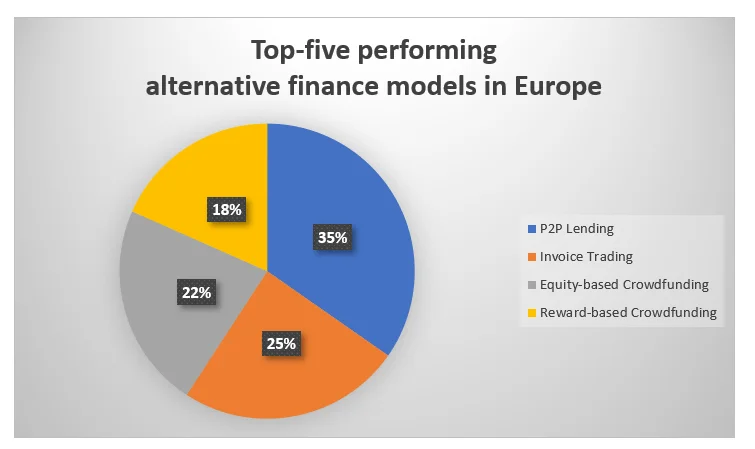

European lending business took a major hit in the wake of 2008 financial crisis. The regulations became stringent and banks became the only source to offer credit. Now, a decade later the economy has started to rise and small and medium enterprises (SMEs) became the drivers of the rising economy. However, it became a challenge to offer these businesses easy access to credit; as demand increased, the capacity of banks in Europe to lend declined. This led to the birth of alternative finance in Europe like P2P lending, invoice trading and crowdfunding.

According to Cambridge Center for Alternative Finance, the alternative finance market in Europe increased by 41% in the year 2016 to reach €2063 million (excluding UK).

- UK stands first in terms of lending volume with 77 platforms in operation.

- The market grew 101% (from €1019m to €2063m) in 2016.

- France (€443.98m), Germany (€84m) and Netherlands (€ 194.19m) stand on 2nd, 3rd and 4th position respectively by market volume.

P2P Lending

Peer-to-peer lending (P2P lending) is an emerging online application where people can directly borrow money from one another. As P2P lending platforms offer these services only online, they can run at lower overhead than the centralized “brick and mortar” financial institutions like banks.

The Peer-to-peer lending (P2P lending) was introduced in Europe in 2005 by UK based company Zopa. For the first time in the financial industry, a third party was able to link the borrowers with lenders instead of banks. Since then, Zopa has matched around 53 000 investors with 114 000 borrowers and making loans of more than £1.4 billion(company reports). Recently, Zopa has been awarded a bank license by the U.K.’s financial regulators, the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA). Acquiring the bank license seems to be just a beginning, it will also roll out a money management app, and various financial products. When launched, Zopa’s bank will be the first hybrid peer-to-peer and digital bank offering.

Invoice Trading

Invoice trading is about selling invoices through online platforms for increased cash flow. In general, invoice trading is a quick way to connect businesses looking to raise capital with investors looking for short-term return.

The invoice trading method works as an immediate funding source – as business get capital often within a day’s time, and this helps to clear balance sheet. As securing adequate means of liquidity, is becoming more critical for corporations, invoice trading have emerged as a logical way to enhance working capital.

Since 2009, invoice trading in Europe has increased at a compound rate of 10%. y. In 2011, the market was worth over €1 trillion as businesses turned to alternative finance solutions like invoice financing, asset-based lending, supply chain finance and trade receivables securitization post the financial crisis of 2008.

Crowdfunding

Crowdfunding is a collective method of raising resources and funds from a large number of people via an internet platform. In return for their contribution, the ‘crowd` receives tangible or intangible assets from the company. Crowdfunding platforms helps to raise funds for not-for-profit and for-profit projects or organizations. There are four main categories of crowdfunding available namely:

- Donation-based: In this type of crowdfunding, people may or may not receive any reward for their contributions. Although, depending on the project and its jurisdiction, people can claim tax deductions for their contribution.

- Reward based: Here people can claim goods or services in return of their contributions

- Lending based: The contributor receives interest payments in return of offering liquidity to the project. The interest payments in general are offered for a particular time frame only.

- Equity-based: In exchange of their contributions the people receive company shares. As the share price grows, their investment also grows.

With the growth in technology, online alternative finance options are also growing. The financial service market is going through a profound change and it is eventually going to re-shape the banking industry overall. Alternative finance in Europe provided around 1.14 billion euros to more than 14,000 businesses.

Being a part of the industry with Akeo Lending, we wish to raise awareness about the alternative finance options in Europe. Also, going further we would delve into a number of questions driving interest in the lending market today like:

- How is the lending market maturing and diversifying?

- How is the growth of the lending industry in Europe?

- What is driving the increasing focus on alternative finance?