Yes, it was public blockchains which showed the world the tremendous potential of the distributed ledger technology. But private blockchains were the ones which became the beacon of hope for industries and changed the way enterprises think about trust in business. The industry experts believe it is going to be private blockchains which are going to be the driving narrative of the year 2019.

If you don’t yet know the difference between Public and Private blockchain, read here.

JP Morgan- the Wall Street mega-bank co-developed Quorum blockchain along with Ethereum startup Ethlab in the year 2016. A private, permissioned blockchain, Quorum has been an Ethereum-forked variant blockchain which uses cryptography to prevent nodes outside the network from seeing sensitive data.

As more projects began building on Quorum, a privacy-centric fork of Ethereum, it became obvious to many in the blockchain world that a bank isn’t the right place to maintain a large scale open-source software project.

“The creation of Quorum was a first for J.P. Morgan, both in terms of developing its own blockchain protocol, and open sourcing software for the developer community,” said Umar Farooq, Global Head of Blockchain, J.P. Morgan. “We’re incredibly proud of the usage of Quorum over the past few years and are excited to have ConsenSys as a partner to take the vision forward.”

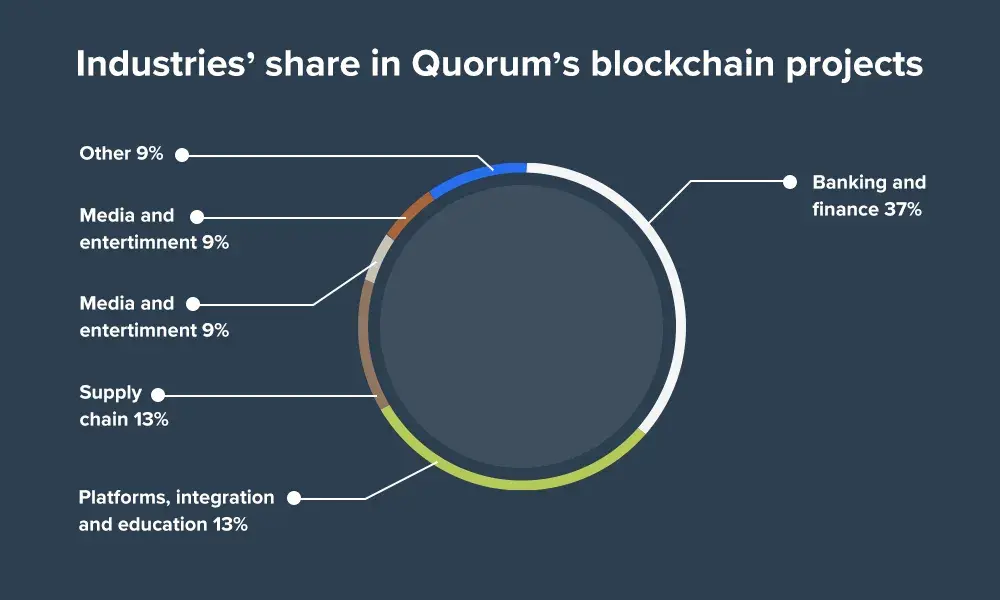

Quorum blockchain unlike the previous thoughts has been adopted across various industries, with just banking and finance industry taking a chunk of 37%. An open source project, Quorum is designed to enable quick trade execution across all asset classes, right of asset ownership, exchange of payments, as well as the movement of collateral. Moreover, with Quorum JP Morgan is looking forward to changing the current reconciliations-based model of the finance industry across the world with instantaneous settlements cycles and the central counterparties with real-time reporting.

Why Quorum Blockchain is forked from Ethereum?

Blockchain as a decentralized technology has raised important concerns which has led banks and other financial institutions to be hesitant about adopting it. Immutability and quick traceability- advantages that Ethereum blockchain offers are great but traditional bank would not want to expose their data and entire record of the transactions to the public. In addition, as ethereum smart contracts are also publicly exposed, this also raises concerns for organization like banks.

With blockchain technologies like Quorum and R3’s Corda being a part of the banking and financial industry, we believe the traditional banking has started the process of reshaping and concepts like Open Banking are also being adopted across the world.

Quorum is designed to solve these issues with four major distinctions: permissioned network and peer environment, enhance transaction speed, smart contract privacy and consensus mechanism based on voting.

Quorum- A Permissioned Blockchain

Quorum is a permissioned blockchain, translating that the network is not open for all. Quorum can only be implemented between parties who are pre-approved by a central entity. A consortium permissioned blockchain runs with the same attributes and protocols of a permissionless blockchain, the difference being the information is available to only permissioned nodes. Let’s have a look at some features of Quorum.

Changes in Quorum over go-ethereum:

- Privacy – Private transactions as well as private contracts are going to be supported on Quorum via public/private state transactions. The platform utilises peer-to-peer encrypted message exchanges – Constellation and Tessera to send private data to the participants of the network.

- Quorum’s Alternative Consensus Mechanisms – With Quorum blockchain one doesn’t need POW/POS rather the network offers multiple consensus mechanisms which are more suited for the consortium chains:

- Raft-based Consensus – a consensus model for faster blocktimes, transaction finality, and on-demand block creation

- Istanbul BFT – a PBFT-inspired consensus algorithm with transaction finality, by AMIS.

- Clique POA Consensus – a default POA consensus algorithm bundled with Go Ethereum.

- Peer Permissioning – With peer permissioning the network ensures that only the trusted parties join the network

- Account Management – Quorum introduced account plugins, which allows Quorum or clef to be extended with alternative methods of managing accounts including external vaults.

- Pluggable Architecture – The platform offers the flexibility to the users to install additional features as plugins to the core geth

- Higher Performance – The performance of Quorum is said to be significantly higher with performance throughput in comparison to public geth

Privacy

How to keep the data confidential has always been a concern of the financial institutions. This issue remained unresolved with first two generations of the blockchain. However, Quorum looks forward to resolving this issue by presenting ‘public’ and ‘private’ on-chain transactions.

The private transactions will be confirmed, but the details will not be leaked. Quorum will make use of system called Constellation to secure the message. Constellation will not necessarily run on blockchain however it will encrypt specific messages during a communication. With Constellation, Quorum is simply encrypting certain number of messages and that’s the reason for its superior speed.

Quorum plans to implement privacy in smart contracts also, as banking and financial institutions are competitive sectors and one does not wish to leak information related to investment strategy or transaction data.

Consensus

The consensus protocol for JP Morgan’s Quorum is called ‘QuorumChain’. Only a particular set of nodes are given the voting rights. A smart contract code is written which mentions the nodes who are assigned the voting rights, plus it tracks the status of all the nodes who are assigned the voting rights. Voting is triggered by a voting smart contract and then the nodes vote to commit a certain transaction on the block.

Source

While the Quorum documentation speaks of Raft consensus mechanism numerous times, the developers have not actually used the consensus in Quorum. It stays unclear whether the developers were just trying to draw analogies between the two or they were trying to get inspired from Raft’s mechanism.

Performance

The Quorum development claims that they have been able to solve one of the major issues concerning to blockchain adoption. All thanks to its simplistic consensus mechanism, Quorum runs hundreds of transactions per second. This is a significant improvement from Bitcoin and Ethereum blockchains.

Conclusion

Even though Quorum operates on a restrictive structure based around its permissioned nature and its consensus mechanism is by no means trustless, it has clear applications in a financial consortium. In addition, the network benefits from being a light-weight shift, allowing for future incorporation of code from the Go Ethereum base.

Overall to us, Quorum seems like a great method to pave the way for other financial implementations of blockchain. What do you think?

We have also written a qualitative comparison between Quorum with IBM’s Hyperledger Fabric and R3’s Corda , the pros and cons of each and which one is going to be the technology of the future. Read the blog here.

.jpg)