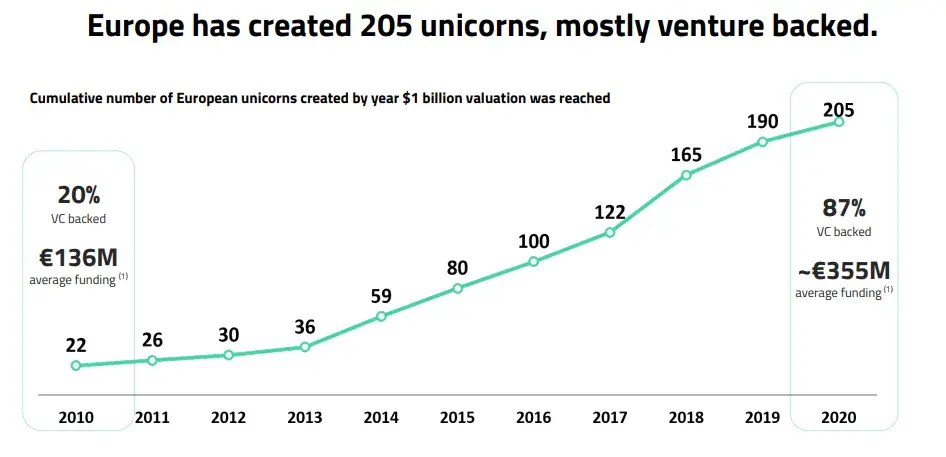

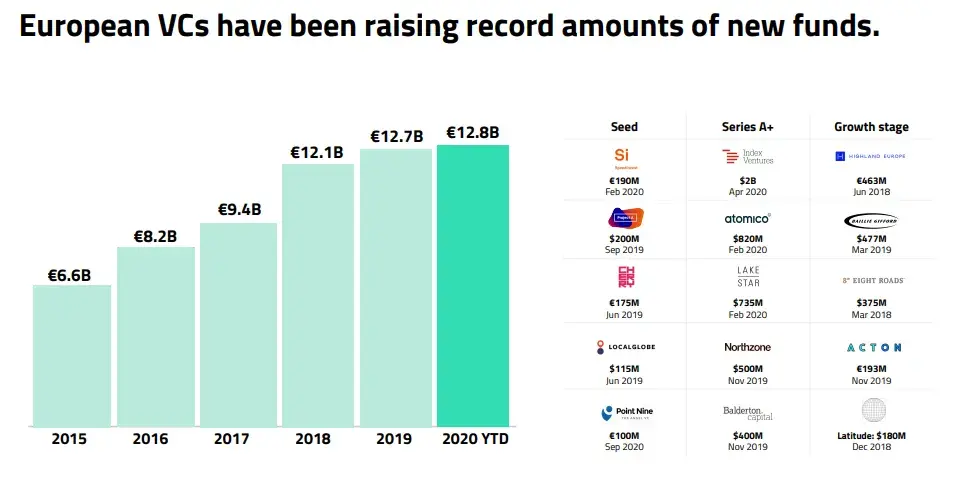

Startups in Europe may have a long way to cross the gap and reach the heights that of Silicon Valley, but it’s on the right track. According to a report published by EuropeanStartups.co, around 205 startups reached a valuation of over $1 billion n the year 2020. Venture capitalists back most of these startups unicorns. Even during the pandemic European startups have well-positioned themselves. Not only the VCs but startups these days also receive long-term support from government institutions.

Yes, the numbers are pretty encouraging and will push a few innovative minds to take the plunge and start their own business. However, having a brilliant startup idea isn’t enough to win over Angel, VCs, and investors in this day and age. They are accustomed to hearing startup ideas every day. To truly grab the attention, you need to demonstrate that your team can turn an innovative idea into an actionable, scalable business.

We offer Akeo Tech-Start as a service for startups and scaleups and help turn their idea into reality. Our in-house experts identify technical opportunities as well as gaps in the idea. The service helps businesses to build something that gives everyone a better understanding of the product.

Wish to know more about Akeo Tech-Start?

While making a pitch to an investor, it is not just about what’s inside the pitch deck. In order to gain their trust, you will need to cut through the noise. Here are six points that will ensure you are putting your best foot forward when you finally sit down to talk with investors.

Don’t believe one pitch will make or break your startup

While making a pitch to an investor, it is not just about what’s inside the pitch deck. To gain their trust, you will need to cut through the noise. Here are six points that will ensure you are putting your best foot forward when you finally sit down to talk with investors.

Live Your Story

When giving a pitch to an investor, it is essential that you live your story. Your story will establish the first connection with the investor. Begin prepping with your team to pull out the correct narrative and kill your nervousness. One must prepare until the pitch becomes second nature, and you can talk about it naturally with anyone. This will help the investors believe in what you are selling.

Remember, you can’t squeeze everything in the pitch

While presenting your pitch, one needs to remember the key points, especially numbers. The projected sales numbers, users, or scale of growth (after a few years) should be on the tips to speak about them conversationally. However, remember that you will not be able to squeeze in everything you wish to convey in your pitch. The Q & A round will offer a better opportunity to pass on the additional information to the investors.

End the pitch as strongly as you start

The simplest way to grab the audience’s attention is to keep the story interesting at the beginning and the end. Remember, it is a movie, and it is equally important to have an exciting start to have a blasting climax.

Forget About Yourself

One of the best pieces of advice is to forget about yourself. All you need to remember while presenting a pitch is your audience. Prepare your pitch like you are answering the question -what’s in it for the investors? Why should they want to listen to you?

Join fundraising for startups program

Startup Norway is organizing a FREE program in association with Innovation Norway. The program aims to support Norwegian startup owners in attracting venture capitalists and investors and growing their companies. The program is meant for startups that want to be fundraising-ready and will help you successfully go through investor meetings and the due diligence process.

Innovation Norway also offers 50 000 Kr to 100 000 Kr grants to startups in the first phase of fundraising. In the second phase, a business with the potential to grow can receive up to 500 000 Kr.

Final thoughts to remember

We recommend that as a startup, one shouldn’t wait to raise money until their bank accounts turn empty. Raising funds sometimes is a long process, and First-time startup founders are often surprised by the drill. As a startup, one should plan the financials for the coming 8-9 months or find themselves desperate.

No startup can be run by just its founders, and the team composition significantly impacts its investors. Try to combine the team’s relevant experience and expertise as one of the vital points of your belief in future success.

Last but not least, it is always better to know what the challenges in a startup are. Investors and Venture capitalists like to know about your perceived challenges, and no startup becomes a successful business without challenges. In this equation between a startup and its investor, it is essential to be transparent. The transparency will help you reach out to your investors to resolve any issues you face.

We believe this will help you prep up for a meeting with potential investors. You have a good knowledge of all the necessary ingredients to produce a winning pitch. If you still feel stuck and need help, we suggest you reach out to us and allow one of our experts to help you out!

Book a free meeting

.jpg)