Uber as a cab service platform is known to most people across the world. However, while commuting from one place to another with your friends, have you ever noticed the fare could be different for you and your friend? In business terms it is called ‘dynamic pricing,’ and in today’s world, this dynamic pricing is assisted with algorithms to automate pricing in real time.

Now the question arises how these algorithms work? These algorithms work on data analysis. Large amount of data these days are collected by companies to uncover correlations, understand hidden patterns and gain insights about customers. With Big Data analytics, Artificial Intelligence and Machine Learning, it has now become possible to analyze large chunks of data and get answers from it almost immediately.

Data is everywhere!

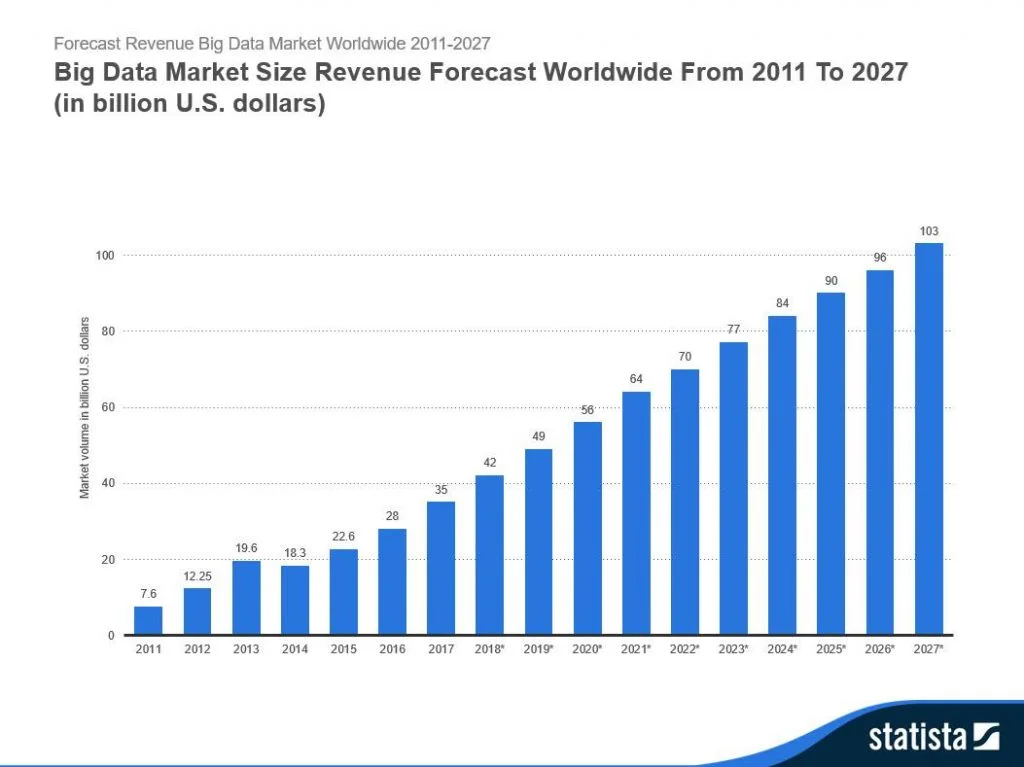

In a recent article, Forbes mentioned that the amount of digital data is doubling every two years and changing the way we live. By the year 2020, every individual is projected to generate 1.7 megabytes of information every second. Companies like Google, Amazon, Netflix, Facebook know what you as a customer are looking for.

Whether it is a new pair of headphones that you’ve been eyeballing or thriller series/movies that you like- businesses are using predictive algorithms via data analysis to catch your attention and sell you stuff rather quickly.

How does Data Analytics help companies?

Making better business decisions Business decisions these days are more based on real data and analytics rather than gut feeling or assumptions. However, for this to happen, access to data shouldn’t be limited to IT company or business analyst rather employees across the company should be able to explore data so that they can help resolve business questions at their level.

Walmart offers all its employees access to data. However, it is in a controlled way. Therefore, the non-technical people don’t get overwhelmed with all the numbers and a large chunk of information. The company has a platform called Walmart Data Café, where hundreds of streams of internal as well as external data are studied and interpreted to deliver insights. The different teams across the company are free to take up their business issues or questions to the Data Café’s expert and find the answer.

Let’s understand it with an example: A sales team might be trying to understand the drop-in revenue at a particular store. By taking the help of the Data Café analyst, the team realized that the pricing miscalculations has led to a decrease in sales. The competitor’s retail store was offering massive discounts driving the store customers to buy groceries and daily items from there.

Know your customers We all wonder how much information Facebook has about us and how the social media giant is using it to show relevant recommendations. Food applications also leverage data to offer dynamic discounts to customers based on their ordering frequency and food preferences. Disney is utilizing data analytics to understand visitor’s behavior at its parks across the world so that the company can offer a fantastic experience for the resort guests. The company is using an AI incorporated wristband known as MagicBand.

Generating an Income One of the most significant advantages of data analytics these days that can be monetized to increase revenue or create an altogether new income stream. Credit card company American Express has the access of more than 25% credit card transactions done in America. The company has information about both sides of the parties – businesses as well as customers. Now, Amex is going to utilize the information to bring businesses closer to its customers. Amex’s merchant services now include web trend analysis and benchmarking tools to help companies to know their hold in the market in comparison to their competitors.

Amex is gaining as it offers an incentive for businesses to adopt their services. More business adoption translates to more revenue generation for the company. Also, with the help of data-driven fraud-detection technology, banking, and finance industry can save millions of dollars.

But how are businesses collecting data?

One of the significant mistakes businesses make is that they don’t have a system in place to adequately support the data analytics efforts.

- Who is managing the data?

- Who is responsible for data collection?

- Who is analyzing the data?

- Who’s updating the data?

- How often are business reports created based on data collected?

If the answer to even one of the questions mentioned above in your mind is vague, your business needs to define the data managing process. Also, before data is collected, as a business, one needs to build the system and keep dedicated employees in place. With real-time information becoming so readily available, we all understand that an outdated database will be one of the easiest ways to put a business in jeopardy. If, nothing else, do ensure that your data is pure and refined, and this means someone needs to be held accountable for storing data.

The other side – General Data Protection Regulation (GDPR)

We no doubt agree that businesses do need data and information in this day and age to grow and build customized services. However, what and how much information they are collecting about a customer and how they are processing and storing that information is crucial. Instead of the public’s concern over privacy, European government introduced GDPR in the year 2018 to protect and regulate data. After knowing about data breaches from a social media giant like Facebook, policies like GDPR are much needed and not just in Europe but across the globe!

We’ll be talking about GDPR and how it can affect businesses in our future article, so stay tuned!